2010 Tax Filing Tips

Priceline Bidding Tips

What is Iaidō (居合道)? Local resources:

Federal Tax:

- Monthly Tax Deposit (Withhold Tax + FICA x 2): Due 15th of the next month.

- Quarterly Form 941 Report (IRS will send the Form, but it can be downloaded online): Due end of the next month (April, July, October, January)

- Yearly Form 940 Report (IRS will send the Form, but it can be downloaded online): Due 01/31.

State Tax (Virginia):

- Monthly State Tax Deposit (Online at VA Tax Department)

- Quarterly State Unemployment Tax (Online at VA Tax Department)

- Yearly Business Income Tax (Online at VA Tax Department)

Tax Filings:

- W2 & 1099 - due 01/31

- 1120S (S-Corp) - due 03/15. SIGN BOTH 1120S AND VA502, PUT VA502, AND VK-1 ON THE TOP of 1120S, MAIL THE WHOLE PDF FILE TO VA, ADDRESS IS ON THE TOP LEFT CORNER OF VA502.

- Virginia Annual Income Tax - due 03/01

- 1040 and State Tax Filing - due 04/1.

- Deposit "401(K) Employee Salary Deferral" (Max = $16,500) by 01/15. For example, John has an annual salary of $100,000 and deposit $16,500 as employee deferral. So in his W2, Box#1=83,500; Box#3 and Box#5 = 100,000; Box#13 has "Retirement Plan" checked. This deferral amount of $16,500 is to be reflected in 1040 Form. The Federal and State Tax will be based on 83,500.

- Deposit "Profit Sharing" (25% of W2) by 04/15

- Deposit Roth IRA ($5,000) by 04/15

- Employee Benefits Legal Resource Site

- Virginia Vehicle Tax

- Mortgage Loan Interest Payment (1098)

- Property Tax and Home Owner Insurance

- W2, 1099

- Stock Sales Spreadsheet (==> Schedule D)

- LLC Business Expenses (==> Schedule C)

- Property Settlement sheet (==> Schedule E)

- Repair & Improvement, Depreciation, etc (Schedule E)

- Energy-Saver Appliances and Home Improvement

1. We are entitled to a copy of our credit reports once a year from the three major credit bureaus. They are available free at AnnualCreditReport.com

2. The health care reform act requires health care insurers to cover preventive care, including cancer screenings, cholesterol tests, mammograms and other preventive services without charging you a co-payment, co-insurance or deductible.

3. As part of the compromise to extend the Bush tax cuts, Social Security taxes will drop to 4.2% from 6.2% for 2011. So, please increase your 401(k) contribution.

Avoid an Audit: 6 'Red Flags' You Should Know

IRS Audit Red Flags: The Dirty Dozen

4. Home office deduction.

5. Business meals, travel and entertainment.

6. Claiming 100% business use of vehicle.

7. Claiming a loss for a hobby activity.

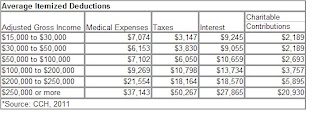

12. Taking higher-than-average deductions.

TAX BRACKET (Year 2010)

If you file taxes jointly with your spouse, the first $16,750 you earn in 2010 is taxed at 10 percent; the next $51,250 is taxed at 15 percent; the next $69,300 at 25 percent and so on. The highest rate you pay is your marginal tax rate, often called your tax bracket.

Here are some of the differences for tax year 2011:

• The $400 ($800 if married filing jointly) Making Work Pay Credit will expire.

• The Social Security payroll tax rate will decrease by 2 percent, to 4.2 percent from 6.2 percent, for wages up to $106,800.

• The self-employment tax will decrease by 2 percent, to 10.4 percent from 12.4 percent, on self-employment income up to $106,800.

• The estate tax will return with a rate of 35% and a lifetime exclusion of $5 million for 2011 and 2012.

• The personal exemption amount will increase to $3,700 (from $3,650 in 2010).

All costs of Edward Jones:

IRA#1: USD 20.00

ROTH#1: USD 40.00

ROTH#2: USD 40.00

TRUST (OWNER'S 401K PLAN): USD 250.00 plus 1% soft cost (per plan, NOT per person)

Term: Annual

Shop for Term Life Insurance:

Click here for quick quotation.

On 2011-12-28, 10-Year Term, GENWORTH LIFE, 250K, 500K, 750K, 1M: $69, $122, $175, $228.

The original rate (non-smoker), 30-Year Term, 1M: $145 or $178.

See this on 12/15/2013, Possible Tax deductibles:

State Sales Taxes

Reinvested Dividends

Out-of-Pocket Charitable Deductions

Student-Loan Interest Paid by Mom and Dad

Job-Hunting Costs

Moving Expenses to Take Your First Job

Military Reservists' Travel Expenses

For the Self-Employed: Deduction of Medicare Premiums

Child-Care Credit

Estate Tax on Income in Respect of a Decedent

State Tax Paid Last Spring

Refinancing Points

Jury Pay Paid to Employer

American Opportunity Credit

A College Credit for Those Long Out of College

Those Blasted Baggage Fees

Credits for Energy-Saving Home Improvements

Bonus Depreciation ... And Beefed-Up Expensing

Break on the Sale of Demutualized Stock

Social Security Taxes You Pay

Waiver of Penalty for the Newly Retired

Reinvested Dividends

Out-of-Pocket Charitable Deductions

Student-Loan Interest Paid by Mom and Dad

Job-Hunting Costs

Moving Expenses to Take Your First Job

Military Reservists' Travel Expenses

For the Self-Employed: Deduction of Medicare Premiums

Child-Care Credit

Estate Tax on Income in Respect of a Decedent

State Tax Paid Last Spring

Refinancing Points

Jury Pay Paid to Employer

American Opportunity Credit

A College Credit for Those Long Out of College

Those Blasted Baggage Fees

Credits for Energy-Saving Home Improvements

Bonus Depreciation ... And Beefed-Up Expensing

Break on the Sale of Demutualized Stock

Social Security Taxes You Pay

Waiver of Penalty for the Newly Retired

2 comments:

This article is very helpful.

I just want to share a PDF filling out tool I've discovered, just in case you need it.

PDFfiller.com allowed me to upload word and powerpoint document to be converted to PDF. Let's me fill out the form neatly and after I had the capability of either to save, print, fax , share or SendtoSign the forms.

I was able to get also the form i need through http://goo.gl/qm54y9.

Such a great experience!

Thanks for sharing. Let me take a look.

Post a Comment